Meet the Rivers

Sam Rivers, 42, always knew his parents, Tom (68) and Linda (65), planned to spend their golden years on their family farm. The farm, which has been in the family for centuries, wasn’t just a piece of property; it was a living testament to decades of hard work, cherished memories, and the Rivers’ independent spirit.

“Mom and Dad have always been clear about wanting to age in place,” Sam explains. “But like many adult children, I found myself struggling to start the conversation about how to make that happen financially.”

Sam admits to putting off these discussions. “It felt awkward to bring up money and long-term planning with my parents. I was afraid they’d think I was overstepping or, worse, after their money. Plus, part of me felt like it was too early – they’re still active and independent. I kept telling myself we had plenty of time to figure things out.”

The Tipping Point

A minor health scare affecting the mobility in Tom’s legs brought the family’s long-standing plans into sharper focus.

“Mom and Dad have always planned to stay on their beloved farm for as long as possible,” Sam explains. “But Dad’s mobility issues made me realize we need to accelerate our financial planning. The timeline for when they’ll need help maintaining the property has suddenly shortened.”

Living at a distance from his parents’ farm, Sam felt an urgent need to start organizing their finances. “I suddenly realized how little I knew about their financial situation. How could we budget for increased maintenance help sooner than we expected? What about potential in-home care costs down the line? I needed to figure out how to make their wish to stay on the farm a reality, but I didn’t even know where to start.”

Sam decided to try out Sabal Finance.

Starting the Conversation with Sabal

Opening Up with Contact Lists

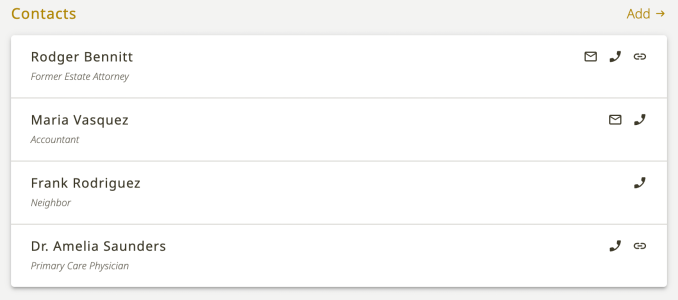

Sam started by inviting his parents to join his Sabal workspace and add their contacts. “It was an easy way to start getting them comfortable with the app,” he explains. “Plus, it gave us natural conversation starters about their doctors, friends, and other important people in their lives.”

As they were adding contacts, they realized their estate planning attorney had retired. “It was a surprise,” Sam recalls. “We hadn’t thought about their will in years, and suddenly we realized we didn’t even have an active attorney. It really drove home how important it is to keep these things to date.”

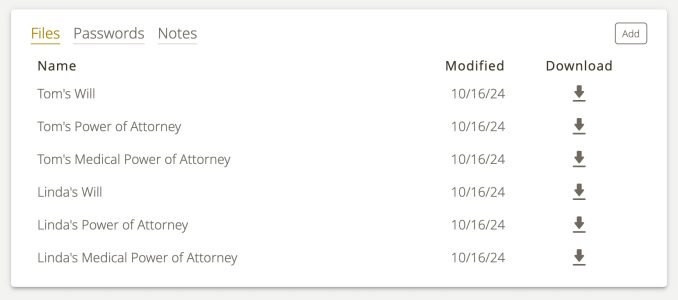

Secure Document Storage with Vault

Next, Sam suggested they use Sabal’s Vault to store important documents. “We started with their wills,” he says. “That’s when we realized they hadn’t been reviewed in over a decade. They’re definitely due for an update.”

As they continued to upload documents, Sam noticed something concerning in Linda’s Medical Power of Attorney. “The document gave both Dad and me the same powers and the ability to act independently,” Sam explains. “I immediately flagged this could potentially cause tension or confusion later on without further guidance from Mom.”

This discovery highlighted the importance of not just storing documents, but also reviewing them carefully. “Without Sabal, we might not have caught this until it was too late,” Sam notes. “Now we can work on clarifying the POA and ensuring all our documents reflect our family’s current wishes and circumstances.”

Discovering Assets

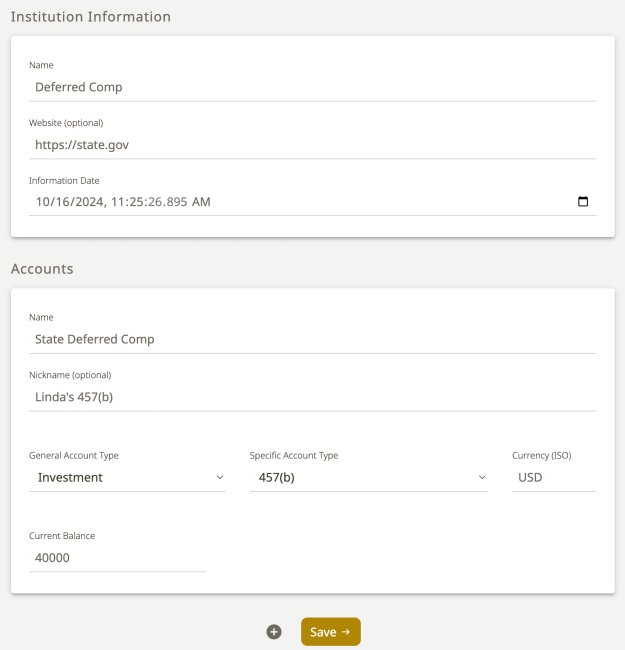

As they began connecting accounts, Sam was surprised to learn about assets he didn’t know existed. “Mom casually mentioned her 457(b) retirement account from her time as a state employee. I didn’t know that was even a thing!”

The process also revealed some minor accounts at a local credit union that Sam wasn’t aware of. “While we could automatically connect their primary bank accounts, I had to add the credit union accounts manually,” Sam explains. “Those smaller accounts could have easily been overlooked. It’s nice having everything in one place now.”

Untangling Property Ownership

The process also revealed complexities in property ownership that Sam hadn’t fully understood before. “Dad’s name was on the family home due to an agreement with his parents, while Mom co-owned a second property with her siblings.” Sam explains.

“We uploaded copies of the contracts to our Vault and added notes about where the physical copies are stored,” he adds. “Having all this information at our fingertips made it so much easier to discuss future plans and potential implications for estate planning.”

Respecting Privacy with Workspace Permissions

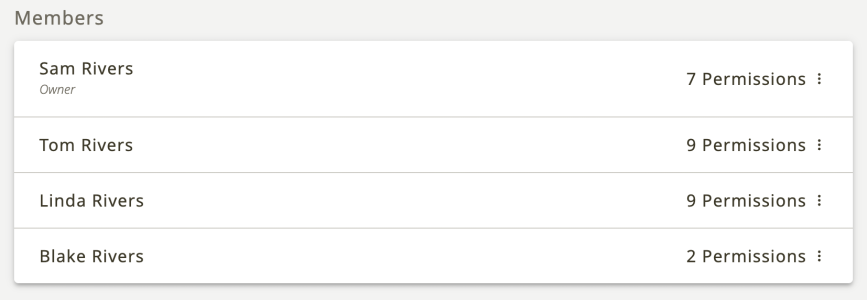

Sam appreciated Sabal’s nuanced permission settings. “I can see some account details without seeing the transactions, and I can see the files in the vault without seeing the passwords. It gives me the overview I need without making my parents feel monitored,” he notes.

The settings also allowed Sam’s brother to get involved in the planning process. “My brother lives closer to our parents, so we gave him access to the contacts list and vault,” Sam explains. “It keeps us on the same page about who to reach out to for certain things. The transparency has really helped avoid misunderstandings too.”

Planning for the Future

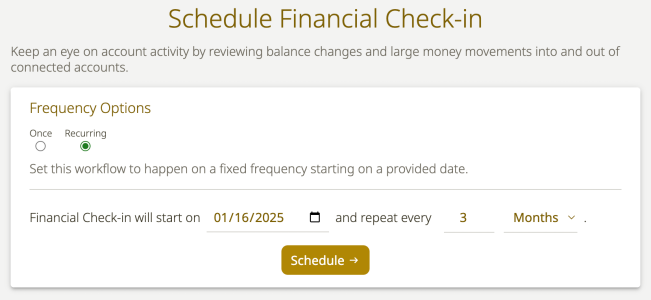

Sam set up a quarterly review using the Financial Check-In checklist template. “It helps us stay on top of things without being overwhelming,” he notes.

The family’s primary goal? Keeping Tom and Linda in their family home as long as possible. “Now that we have a clear picture of their retirement income, we can start budgeting for property management assistance,” Sam explains.

The Result: Clear Next Steps

Today, the Rivers family has a concrete action plan. They’ve identified which documents need an update, are working on a budget for future property care costs, and established a quarterly financial review process.

“We’re getting more comfortable talking about these things and starting to build a routine,” Sam explains. “Being proactive brings me a lot of peace of mind. Sabal helped me bring the initial pieces of information together to start building off of.”